Self-Employed Tax Credit

You May Be Eligible For Up To $32,220 In Refunds From 2020 & 2021

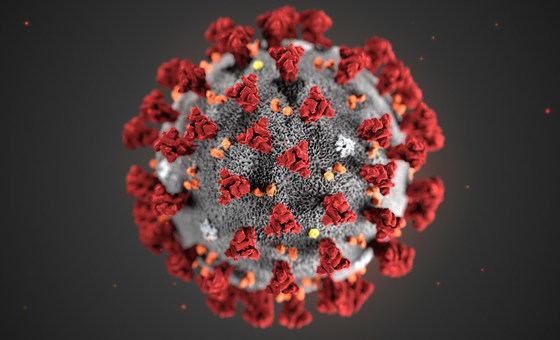

The SETC is a specialized tax credit originating from the Families First Coronavirus Response Act (FFCRA) designed to provide support to self-employed individuals during the COVID-19 pandemic.

Who's eligible?

Is the SETC Legitimate?

Where can I learn more?

What is the Self-Employed Tax Credit (SETC)?

The Self-Employed Tax Credit (SETC) is designed to support self-employed individuals during the COVID-19 pandemic by addressing challenges such as illness, caregiving responsibilities, and quarantine. This credit offers financial relief to eligible individuals affected by these disruptions.

What is the Self-Employed Tax Credit (SETC)?

The Self-Employed Tax Credit (SETC) is designed to support self-employed individuals during the COVID-19 pandemic by addressing challenges such as illness, caregiving responsibilities, and quarantine. This credit offers financial relief to eligible individuals affected by these disruptions.

Who's Eligible for the SETC Credit?

If you were self-employed in 2020 and/or 2021, including sole proprietors, 1099 subcontractors, and single-member LLCs, you might qualify for the SETC. Eligibility hinges on having filed a 'Schedule C' with your federal tax returns for these years

How to Qualify for the SETC Tax Credit

If any of the following COVID-19 related disruptions impacted your ability to work, you may be eligible for support:

Covid-19 Illness

Vaccination Issues

Quarantine

Caring for Others

How to Qualify for the SETC Tax Credit

If any of the following COVID-19 related disruptions impacted your ability to work, you may be eligible for support:

Quarantine

Covid-19 Illness

Vaccination Issues

Caring for Others

Our Simple Process

Calculate & Claim your Tax Credit in Less than 20 Minutes