Apply for the SETC Tax Credit

How to claim the SETC Tax Credit, worth up to $32,220 - No repayment required

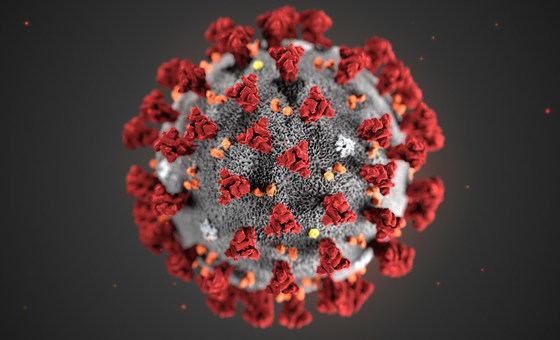

Were you impacted by COVID-19 during the 2020 or 2021 tax year? With the SETC Tax Credit (Self-Employed Tax Credit), you may be eligible to claim up to $32,220 in non-repayable tax credits. Not sure if you are qualified? See the eligibility requirements here.

$0M+

Recovered for self-employed individuals so far!

0M+

Self-employed workers estimated to be eligible

0 Minutes

To complete your e-file SETC application with the IRS

Trustindex verifies that the original source of the review is Google. Lendesca came thru right in time I'm so grateful for this company 🙏.Trustindex verifies that the original source of the review is Google. They helped me so much. And highly recommend it. It was easy and they were quick to respond w any questions I had. Thank you..Trustindex verifies that the original source of the review is Google. Absolutely phenomenal! Very communicative and got things done quickly. Any questions I had were instantly answered. Couldn’t be happier.Trustindex verifies that the original source of the review is Google. The team went above and beyond to help me get my money from the IRS. The process is pretty slick and consistent. It was great doing business with them. I might have to find a reason to use them in the future.Trustindex verifies that the original source of the review is Google. Ill admit, at first i was skeptical but this was real. It was a quick and easy process and the Ladies at Lendesca were quick to respond whenever I had questions or needed help. I think the whole process took 2 weeks before the funds were in my account for my business taxes. I would definitely recommend them.Trustindex verifies that the original source of the review is Google. Awesome companyTrustindex verifies that the original source of the review is Google. Did a great job handling the Mail delays. Thanks for you wonderful service.Trustindex verifies that the original source of the review is Google. Trustindex verifies that the original source of the review is Google. Over all Lendesca is helpful for me and can help everyone in need to reach what he or she expectsTrustindex verifies that the original source of the review is Google.

SETC Tax Credit Application

No upfront payment required

Your Information is Secured

1. Make an Account

2. Estimate your Refund

3. Submit E-File Application

4. Get your Tax Credit

1. Make an Account

2. Calculate your Refund

3. Submit E-File Application

4. Get your Tax Credit

SETC Tax Credit Application

No upfront payment required

Your Information is Secured

What is the SETC Tax Credit?

The SETC Tax Credit is crafted to aid self-employed individuals impacted by the COVID-19 pandemic. It addresses the distinct challenges faced during COVID-19 by providing up to $32,220 in non-repayable tax credits and nearly everyone with Schedule C income qualifies.

If you’ve faced COVID-related challenges impacting your work, the SETC refund is your safety net. The deadline for SETC submissions has been extended to April 2025, allowing more individuals ample time to submit their SETC claims. It only takes 5 minutes to get an estimate and submit your claim.

What is the SETC Tax Credit?

The SETC Tax Credit is crafted to aid self-employed individuals impacted by the COVID-19 pandemic. It addresses the distinct challenges faced during COVID-19 by providing up to $32,220 in non-repayable tax credits and nearly everyone with Schedule C income qualifies.

If you’ve faced COVID-related challenges impacting your work, the SETC refund is your safety net. The deadline for SETC submissions has been extended to April 2025, allowing more individuals ample time to submit their SETC claims. It only takes 5 minutes to get an estimate and submit your claim.

Who's Eligible for the SETC Tax Credit?

Self-Employment Status

If you were self-employed during 2020 and/or 2021, you may qualify for the SETC Tax Credit. This includes individuals operating as sole proprietors with staff, those receiving 1099 forms for contract work, and single-member LLCs. A good indicator that you’re eligible is if you submitted a “Schedule C” with your 2020 and/or 2021 federal tax filings.

Impacted By COVID-19

Self-employed individuals who faced direct or indirect impacts from COVID-19 may qualify for the SETC. If you experienced symptoms similar to COVID-19, had to quarantine, got tested for the virus, or provided care for a family member affected by the pandemic, you could be eligible for financial assistance through the SETC program.

Quarantine

Covid-19 Illness

Vaccination Issues

Caring for Others

Who's Eligible for the SETC Credit?

Self-Employment Status

If you were self-employed during 2020 and/or 2021, you may qualify for the SETC Tax Credit. This includes individuals operating as sole proprietors with staff, those receiving 1099 forms for contract work, and single-member LLCs. A good indicator that you're eligible is if you submitted a "Schedule C" with your 2020 and/or 2021 federal tax filings.

How to Qualify for the SETC Tax Credit

Impacted By COVID-19

Self-employed individuals who faced direct or indirect impacts from COVID-19 may qualify for the SETC. If you experienced symptoms similar to COVID-19, had to quarantine, got tested for the virus, or provided care for a family member affected by the pandemic, you could be eligible for financial assistance through the SETC program.

Covid-19 Illness

Vaccination Issues

Quarantine